By Jenny Sutton

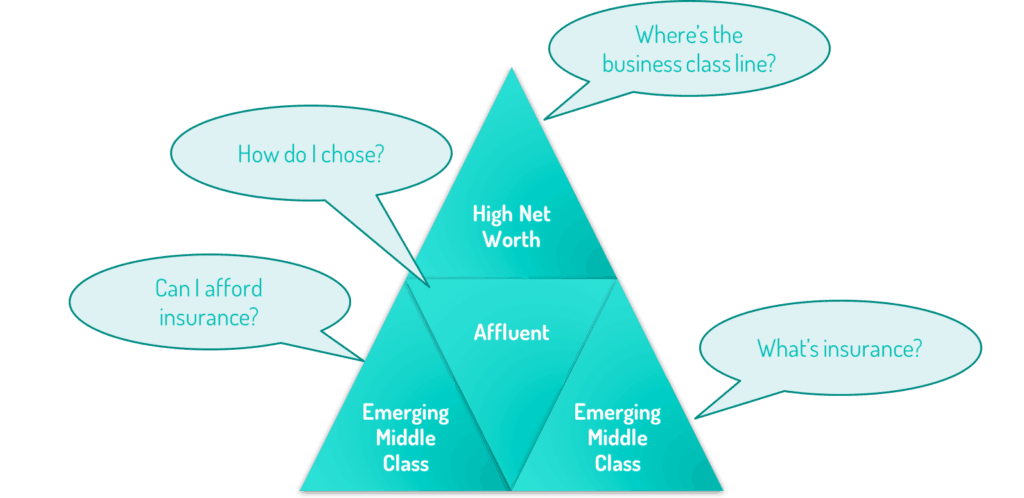

Insurance CEOs face a dilemma: Should they invest in growing the least profitable part of their business, in order to attract and retain the most price-sensitive customers, or should they continue their focus on the customers that buy the big ticket, more profitable products?

The insurer’s dilemma

This is the “Innovator’s Dilemma” that Clayton Christenson spelt out in his 1997 book where he was referring to steel mills. But this dilemma is not unique to the steel industry. In many industries, companies have focused on driving larger margins associated with incrementally better products out of their existing loyal customer bases, rather than identifying how to serve new customers, generally at the lower end of the financial pyramid.

The phenomenon of budget airlines was born out of this – startup airlines targeted people who otherwise would not fly. People who simply want to get from A to B at the lowest cost, and do not need all the additional services that are packaged into tickets with a traditional airline (free meals and alcohol, baggage allowance, pre-assigned seating etc).

Organisational inertia

Patterns of investment, resource allocation and innovation in organisations tend to be aligned with each other. Therefore when innovative new business models are only initially viable in untapped market segments, resource allocation mechanisms will deny funding to projects required to establish such models.

Executives question the deployment of organisational resources and capital on a project where returns do not meet hurdle rates, and where success is not guaranteed. In a corporate environment, career preservation instincts favour the pursuit of projects that upper management will readily sign-off on. Therefore the typical corporate response to the emergence of new business models is to double down on investments in the models used to serve existing markets.

Nowhere is this more true than in the life insurance industry where the agency channel’s demands for new products promotes on-going investment in existing customer segments. In addition, the risk-averse nature of the industry, the strain of new business on capital in growing markets, and the holy grail of alpha all mitigate against investment in new, risky, business models.

Actionable segmentation

Insurance companies have talked about customer centricity for decades.

But most have focused on demographic segmentation of customers for purpose of identifying the next product to offer. Few have implemented the associated client experience model (distribution, product, price, services) that is matched to what each segment values.

The one-size fits all sales model is partially to blame. In the prevalent agency model, it is hard to direct or limit agents to specific segments, and to dictate a different engagement approach for each segment.

Differentiation should not stop at the point of sale – it must extend across the value chain – including the quality of the policy documentation, the service channel assigned and invitations to exclusive events or offers. Therefore, even within the socioeconomic groups that insurance companies traditionally target, there are hidden, untapped markets in the form of the underserved, underinsured, uninsurable groups.

Budget Insurance

At the lower end of the spectrum are the non-consumers – customers who have never bought insurance because existing channels do not reach them or are too expensive to do so, or because current products are laden with features that these customers cannot afford.

In many cases this is a deliberate choice – the insurer’s focus is on the affluent and emerging affluent customers. Traditional life insurance companies are not architected to sell or deliver a low margin, high volume offering. The personal selling process, coupled with the intensely manual back-office systems and processes demand a minimum expense loading for each and every product sold that outstrips the margins of simpler, lower-priced solutions.

Business class

Although many insurance companies are specifically focused on the high net worth category as a growth segment, the “white glove” underwriting and sales support service required to attract and retain those customers is often lacking.

High net worth customers have many financial options, and insurance companies have to convince not only these customers, but also their private bankers and brokers that they have earned the right to sell in this space.

Insuring the uninsurable

Underserved segments are not only defined in socioeconomic terms. Other clusters of customers are often denied coverage or not offered a relevant solution, creating opportunities for new companies to focus on these segments.

Bought By Many (UK) sources insurance for small groups with unique insurance needs; and AllLife (South Africa) has a unique proposition for people living with HIV or diabetes. Trov (Australia) and Zhong An (China) have created new types of general insurance for risks that were previously considered uninsurable. These companies are the forerunners of technology-based and data-driven new players that are dedicated to providing coverage for segments previously considered too hard to price, and therefore not insurable.

Millennials think differently

Millennials’ shopping behaviours are influenced by (amongst other things) the immediacy of technology and a different communications paradigm. Search Twitter for “insurance” and “complaints” and you will see the unanswered laments of a generation of people who expect to engage with insurers over Facebook Messenger, Whatsapp and Twitter – the same media that they use to communicate with their friends.

With so much choice available in all purchasing categories, millennials rely on other people’s recommendations to reduce and simplify decision-making, whether it is selecting music based on a DJ and his playlist or shopping for outfits modelled after those put together by a fashion blogger. Growing up in an era of relative prosperity, financial planning is not a priority for them, and given how much change they have seen in their short life-times, they do not see the value of any type of long-term planning.

Yet insurers are effectively ignoring this segment that is now reaching the insurance-buying life stage by primarily deploying sales and servicing processes based on traditional communications methods and by pushing products that do not reflect millennials’ needs and values.

Enter the disruptors

Disruptors, intent on getting a significant portion of a very defined market, find these types of niches very enticing. They are able to design a unique customer experience that is focused on the expectations and behaviours of a very distinct, addressable population group.

Traditional insurers will respond with updates to products, distribution channels and touchpoints, hoping to compete with completely new business models by simply tweaking their current offerings.

Disruption from within

Insurers need to take a look at their current customer base and decide whether these are the segments to rely on for future growth, thus deliberately ceding currently unprofitable market segments to others.

If they decide to compete in new segments, they will need to make radical changes to their business models – including approaches to product design, distribution channels, customer service capabilities, and the composition of skills and experiences in management and employees. This will require significant investment, tenacity and the willingness to take tough decisions that will ultimately disrupt the organisation, but from the inside.

Originally Published in Asia Insurance Review 1 July 2016