Enabling digital distribution in insurance ecosystems

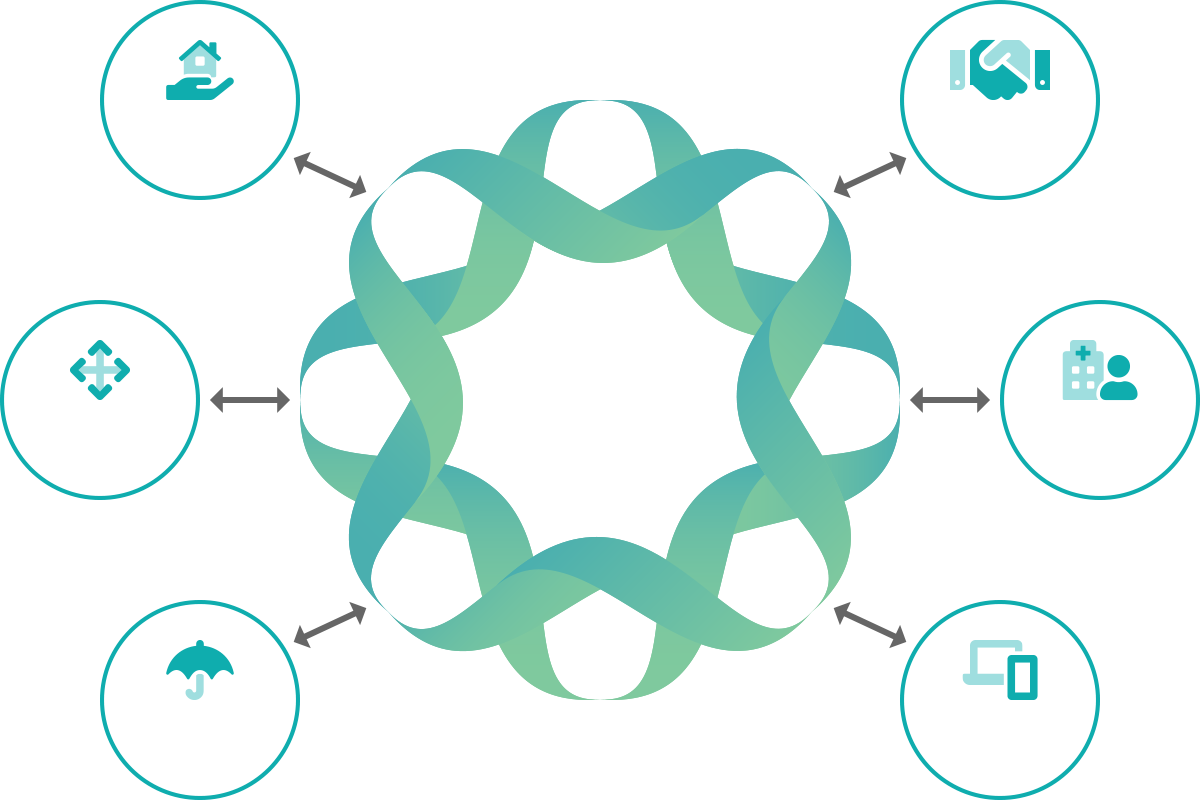

Our platform connects participants in insurance ecosystems like microinsurance, embedded insurance, and digital wallets, with straight-through and real-time client experiences, by providing a shared source of truth and eliminating the duplication of data.

Opportunity and industry challenges

DEVELOPING MARKETS

Emerging middle-class segments

100’s of millions of people in the emerging markets of Asia are entering the addressable market for insurance products, yet insurers are struggling to reach them using their traditional distribution channels and operating models. Insurers require a lower cost platform that natively supports digital distribution to create competitive products. This market is also generating demand for new products such as micro-insurance and parametric based insurance products.

MATURE MARKETS

Better client experience

For mature markets, in a more developed insurance industry, the focus of new revenue is on millennially-minded customers. These segments prefer the direct purchase of insurance policies through digital channels such as mobile apps. Enabling the insurers or distributors with straight-through processing allows integration to mobile apps.

Insurers struggle to address these opportunities and have challenges with the following areas:

Product challenges

Existing products have inflexible structures that are difficult to create innovative and differentiating products. It is costly, time-consuming and not agile.

Legacy systems

Most PAS are based on legacy technology that have hardened through years of maintenance and are difficult to enhance.

Business process challenges

The legacy systems contribute to manual business processes. There are hand-offs internally within insurers and between distributors and insurers. Reinsurers often only get a monthly upload of data.

Incomplete client experience

All of this contributes to an incomplete client experience. For years, insurers have been trying to hide these problems behind layers of technology but Galileo Platforms addresses this at the core.

Insurance Platform on a Blockchain

Our platform drives efficiency through the entire value chain by enabling distributors, insurers, reinsurers, and other relevant parties with permissioned access. The smart contracts on our platform and/or other policy administration systems are joined together and made available through blockchain, APIs, and other current technology.

PRIVATE, DISTRIBUTED, TRUSTED

Our blockchain platform

- Uses private blockchain technology to integrate different participants within the insurance ecosystem.

- Is secure and low cost, the permissioned capabilities allow different parties to operate within the network.

- Manages end to end policy administration functions from new business, claims, servicing and renewal.

- Insurers can either replace or bolt-on-to their existing policy admin systems

Different parties can be integrated in our platform:

Insurers

Manufacturer of the insurance product. Handling underwriting of the policies, claims processing and payment, renewal and servicing.

Distributors and banking partners

Banks, brokers, and other channel distributors (like eWallets) distributing insurance products to customers.

Technology providers

Providers integrating to the platform to provide payment services, eKYC and claims engines.

Healthcare providers

Hospitals and clinics can submit claims on behalf of customers, providing efficient health claims processing.

Reinsurers

Able to get real-time access to their coverages and claims.

Sample use cases and benefits

Galileo Platforms is a platform technology company serving the insurance sector. Using blockchain technology we connect participants in the insurance ecosystem enabling them to deliver a straight-through, digital client experience.

Bancassurance and Insurance Distributors

- Banks are often frustrated in their Bancassurance relationships with the lack of straight-through processing and access to data

- Enables digital distribution of products.

- Insurers can either replace or bolt-on-to their existing policy admin systems

Digital Distribution

- Distribution without the need for endless reconciliations

- Enables real-time integration with digital distributors like e-wallets, etc.

- Straight-through processing of new business for brokers/distributors giving insurer an edge over the competition

- Enables direct model in addition to distributors

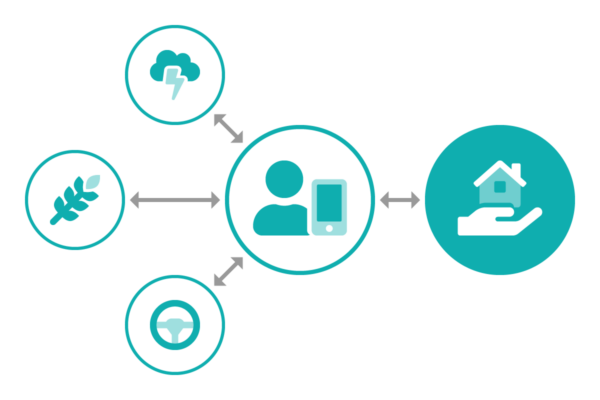

Micro and parametric insurance

- Enables through immediacy and less reconciliation a lower cost-base

- Through eWallet integration able to connect to unbanked clients

- Creates an opportunity for telematics and other parametric input to adjust policy coverages/claims/etc.

Medical Provider Networks

- Streamlined processing of pre-authorisations and claims.

- Cashless claims about direct to the medical provider.

- Better customer centric experience.

Just some of the benefits of the Galileo Platform:

New channels and customer segments

Cost and error reduction

Faster and cheaper product innovation

Golden source for data analytics

Increased profits

Differentiated client experience

Videos

In the media