By Jenny Sutton

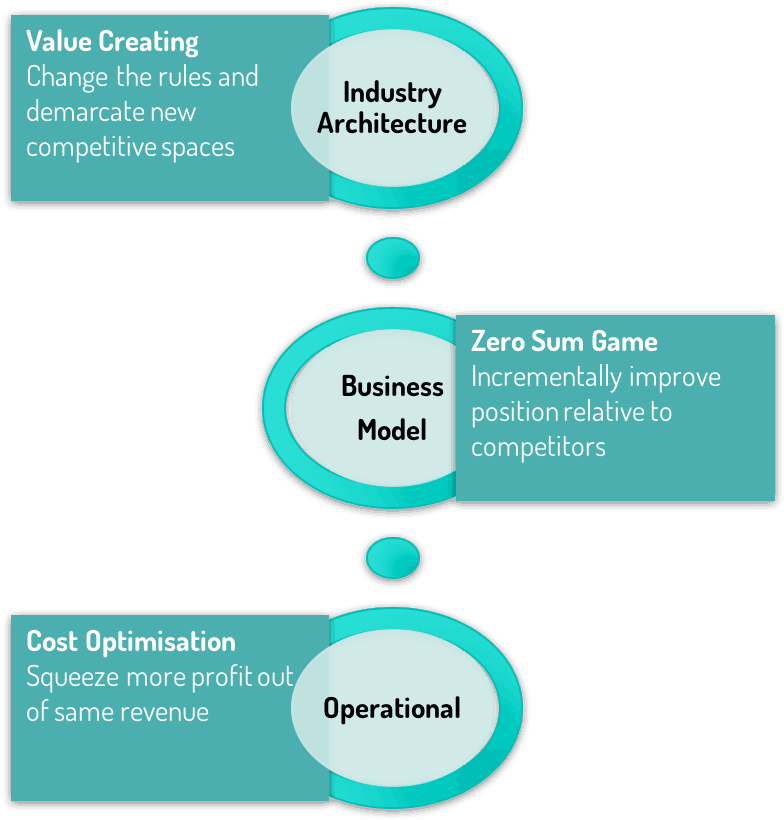

The innovation challenge facing the insurance industry is much, much larger than most insurance CEOs recognise. Too many of the current innovation efforts are still focused on incremental improvements to existing products, processes and systems.

Scope of innovation challenge

Building cool-sounding lofts or garages and experimenting with blockchain have quickly become table stakes. They are not themselves innovative. And most of the projects that they are spawning are also not innovative because they fail to question the fundamental insurance business model and how it must evolve.

Current innovation approaches only distract insurers from recognising and addressing the true scope of innovation that is demanded. They lull insurers into a false sense of security, fuelled by the belief that having an innovation programme inoculates them from disruption.

An innovation mandate to pull the company apart and put it back together differently, even though it may produce a more agile, cost-effective, customer relevant insurance company still embeds insider assumptions upon which the industry as a whole is currently structured.

The real innovation challenge is to look at the entire industry from an outsider’s perspective and consider: If the insurance industry was being designed from scratch today, what would it look like?

Why this approach

The insurance industry is experiencing an unprecedented set of changes. Regulations and compliance requirements aimed at closing tax loopholes, preventing the financing of terrorism, and detecting money laundering, yield no value in meeting insurance customers’ needs. Low interest rates make it difficult to provide

attractive products. Technology, and information, are empowering customers, and making it much cheaper and easier for new entrants. The industry assumptions upon which current products and channels are built are not necessarily valid any longer. Any innovation programme must take the widest possible view of the company’s future. The industry, not the company, is the operating level that innovation programmes need to be aimed at.

Start with nothing/question everything

To redesign the life insurance industry today from scratch, requires a restatement of the most basic assumption – the problem to be addressed. Considering changes in demographics (eg fewer children), life expectations (eg longer lives), social norms (eg nuclear families), and relative changes to the cost of living (eg housing versus education costs), the starting point is to identify the losses that people need to protect themselves, or their families, from if something were to happen to them.

This may sound too obvious. Or may be assumed to be a given. But innovation stems from identifying, or reframing the issue to be solved. Too few insurers are prepared to question everything, and so their innovation programmes are not tackling fundamental industry issues.

Next we need to look at all the potential industry participants. Who should play a role in providing that protection – the individual, a private sector organisation, the community or the state? Or a combination of these?

One future scenario would involve the state having a larger responsibility – at least at the lower end of the economic spectrum. As technology makes economies more productive – producing more outputs with less labour, some countries are already exploring the idea of providing a Universal Basic Income. If countries were to pay their citizens a Universal Basic Income, would the population still need access to life insurance?

These are not just pointless academic questions. Exploring these concepts and ideas unlocks the thought process and unfreezes the mindsets of those tasked with innovation in the insurer, laying the groundwork for innovation at a more ambitious level.

Players and their roles

The next layer at which to analyse the industry is to break down the value chain (or ecosystem) and evaluate how value can be delivered at each and every step.

Take distribution as an example. In the traditional agency and broker distribution channels, the same individual is usually responsible for several activities in the sales process – finding potential customers, providing financial advice and then closing the sale. In a redesigned life insurance industry, all three activities could be optimised by distinguishing them from one another in terms of who performs the activity, what value is delivered and how it is measured.

Prospecting could be done by individuals or entities who are paid to generate leads. Distinct adviser roles, matched to the wealth and sophistication of the customer, could focus on giving objective financial advice (without necessarily promoting a particular insurance company) utilising rigorous planning tools and underpinned by properly earned credentials.

Once the customer has a financial plan, they could be introduced to specific product types and if necessary, the adviser would assist them to select a product provider. Closing the sale and completing whatever administrative steps could be performed by a sales support function.

Each of these activities could be performed by separate entities, and at a different level of aggregation within the industry. Sourcing leads and advising may be done by entities focused on distribution only. While closing the sale may be done by the insurer themselves. Fully segregating each of these three activities would require completely new compensation approaches, and management metrics.

This is just a high level example of the extent of the visioning that insurers need to undertake. Every part of the insurance industry value chain should be examined and dissected – from product design all the way through to customer service and claims – to identify new opportunities, more optimal structures, and better mechanisms to meet the needs of customers. Whether the result is a more or less vertically integrated set of players compared to the current state is irrelevant. The value is in the process of analysis.

Enablers and opportunities

Technology is an area where insurers are guilty of a failure of imagination. Typically, when new technology makes it into the mainstream, and eventually into the hands of insurers, it is deployed to support or optimise existing business models and processes. Instead, each new technology – whether it is Big Data, artificial intelligence, augmented reality or distributed ledgers – should be greeted with a critical assessment of how it could be used, not necessarily by the insurer, to fundamentally change the structure of the industry.

Be more ambitious

A more radical approach to innovation is required for insurers to claim their position in the evolving insurance landscape. To do this insurers need to view themselves from outside of their current organisations, and redesign the industry as a whole, without any agenda or preconceptions.

Redesigning an entire industry should not just be regarded as a fun, intellectually stimulating exercise, but nevertheless a pointless waste of time, because of practical implementation realities. The value is in the process and the new insights that will be generated.

Examining the industry as a whole will fuel ideation and provide the basis for identifying truly innovative concepts that the insurer can implement before someone else, probably from outside the industry, does.

Originally Published in Asia Insurance Review 1 Sep 2016